At the end of March 2023, the Centers for Medicare & Medicaid Services (CMS) announced the 2024 Medicare Advantage Rate. The proposed rule introduces major changes to risk adjustment payment policies. Additionally, CMS projects that the plan will lead to a payment increase for Medicare Advantage (MA) plans from 2023 to 2024. The CMS press release explains that the proposed policy change was designed to “improve payment accuracy and ensure taxpayer dollars are well spent.”

Earlier this year, the MA community voiced concerns over how difficult it would be to accommodate the proposed changes all at once. CMS appears to have taken note of these concerns, adding a “phase-in” approach to the policy. Between 2024 to 2026, risk scores will be calculated with a blended model, gradually phasing out the 2020 risk adjustment model by 33% a year. Management Service Organizations (MSOs) will appreciate the slow roll out, as they’ll have more time to adapt to the new model. Though, some still argue that the phase in blending model will also present its own difficulties.

What to Expect with HCC v28

One such difficulty may be for MSOs who have to work with various risk score models in mind. While the gradual blending phase in will likely alleviate the process, the proposed model still includes the removal of 2,234 codes that map to Hierarchical Condition Categories (HCCs). This significant change puts additional pressure on coders to ensure the HCC codes they apply to charts are correct according to the payment year they are auditing.

As stated before, the new policy will be phased in between 2024 to 2026:

- For CY 2024, risk scores will be calculated as a blend of 67% of the risk scores calculated with the 2020 risk adjustment model and 33% of the risk scores calculated with the updated 2024 model.

- For CY 2025, CMS expects risk scores to be calculated as a blend of 33 percent of the risk scores calculated with the 2020 model and 67 percent of the risk scores calculated with the 2024 model.

- For CY 2026, CMS expects that 100 percent of the risk scores will be calculated with the 2024 model.

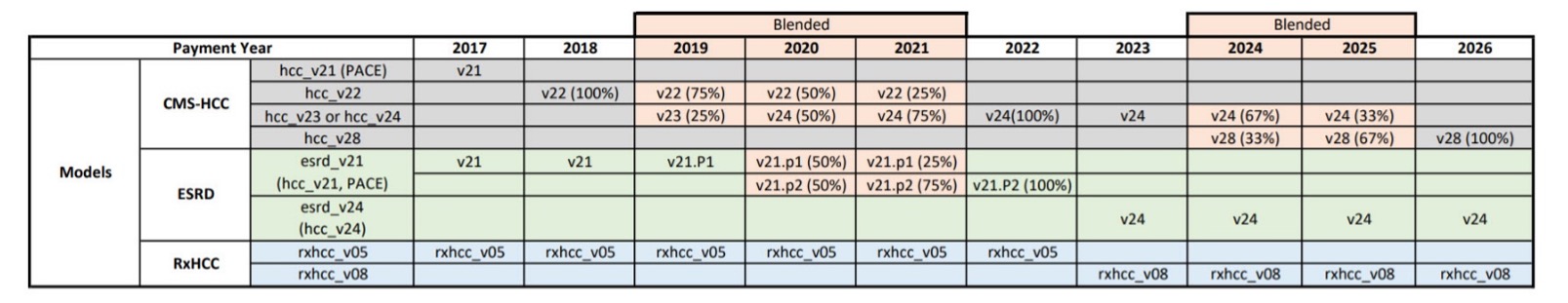

This is not the first time CMS has phased in changes to the HCC model. CMS also phased in the 2014 model. The previous phase in of the 2014 model included changes to clinical reclassifications, much like the proposed changes in the 2024 model. Both RxHCC v08 and ESRD v24 models were added for payment years 2023 and 2024 (see figure 1).

CMS-HCC, ESRD, and RxHCC updates between 2017-2026

According to the 2024 Medicare Advantage and Part D Rate Announcement published by CMS on March 31st, the new HCC model is better than the previous model because “it reflects more recent diagnoses and costs (2018 diagnoses/2019 costs compared to 2014 diagnoses/2015 costs) and includes clinically meaningful conditions that predict costs developed from experience with ICD-10 and with clinician input.” This statement is backed up by multiple accuracy analyses previously conducted by CMS.

Increase in Medicare Advantage Payments

In February of 2023, CMS announced the potential of a 1% increase in MA payment overall. Many were surprised when the projected 1% rose to a 3.32% increase in payments following CMS’s follow up announcement of the update. According to their press release, CMS now anticipates over 13 billion dollars of an increase in MA payments. The update also “reflects a 2.28 percent increase in the MA payment effective growth rate, a 1.24 percent decline in star ratings and a 4.4 percent increase in the MA risk score trend.”

This increase is based on changes to Star Ratings, the risk adjustment model revision, risk score trends, and the Effective Growth Rate (EGR). The EGR considers inflation trends and the most recently updated estimate of Medicare FFS costs per capita adjusted to factor in MA plan payments.

An Opportunity to Improve

While the proposed changes are fresh and refinements to the update are still possible, many MAOs are keeping their ear to the ground as CMS rolls out the update.

As with any other major update to the risk adjustment model, this change provides an opportunity for providers to recommit to their patients by keeping patient plans up to date, accounting for all conditions, and prioritizing patient care. Ultimately, accurate coding and careful consideration of HCC risk adjustment practices will go a long way in preventing over, and under, payments when it comes time to chart patient diagnosis codes.

The rule will go into effect on Jan. 1, 2024. For more information, click here.

Leave A Comment