As discussed in a previous article, Medicare Risk Adjustment requires careful collection and validation of patient diagnosis codes before coders can successfully complete their HCC reviews. This work is very important: it is forecasted to drive the alignment of approximately $460 billion in Medicare spending in 2023, according to the Congressional Budget Office.

In fact, CMS reports that as of January 2023, approximately 29.6 million Medicare eligible beneficiaries are enrolled in Coordinated Care Plans. This is an increase from more than 28 million as of 2022, which at the time was nearly half or “48 percent of the eligible Medicare population, and $427 billion (or 55%) of total federal Medicare spending (net of premiums).” In 2021, this was 21% of national health spending and 10% of the federal budget. Does anybody have a calculator?

YES WE DO!

Medicare Advantage enrollment has been steadily increasing throughout the last ten years, and to ensure adequate financial support for risk of total cost of care, health plans and risk bearing provider organizations like MSOs and ACOs must ensure their HCC coding his accurate.

With all the work that goes into these reviews – and the limited time to do it, coders face the risk of focusing on the wrong cases and the uncertainty of knowing whether specific codes that are appropriate are important enough to add back to a recapture cycle. The result of focusing on the wrong cases can be major financial shortfalls for healthcare organizations.

Fortunately, FRG has created an online tool for coders and analysts which aids them during the process of HCC coding reviews by helping to quantify the financial significance of dropped diagnosis in the Medicare Risk Adjustment model. This article provides an overview of the MRACalculator and five of the most powerful benefits of using the online tool.

Introducing the MRA Calculator

We developed our MRA Calculator by forming a team of experts in medical coding, healthcare finance, data modeling and interactive software and then prototyping and testing for three years. It wasn’t easy! Because financial reconciliation reliability has always been our first goal, we focused this discipline into modeling the impact of coding recapture and loss so that FRG’s MRA Calculator could be trustworthy enough to help actuaries build accruals. Then we made it simple enough to for anyone to use.

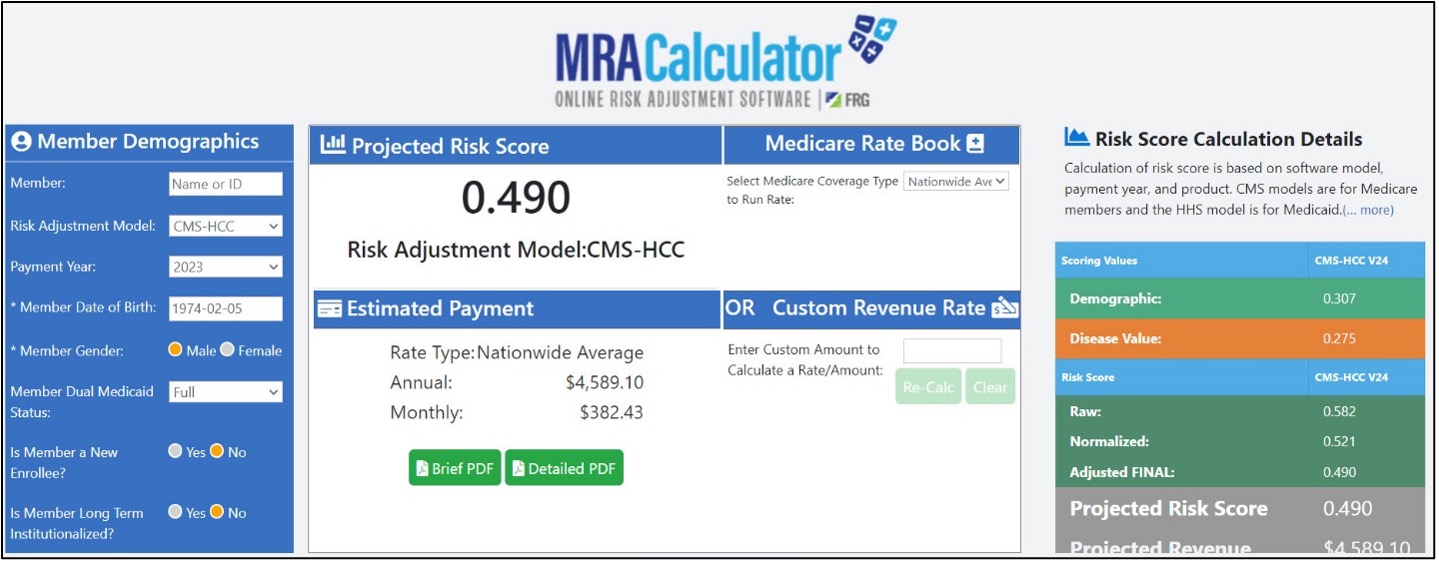

FRG’s MRA Calculator is a tool made specifically for coders and analysts to help the quantify the value of coding recapture and the cost of dropped codes. This helps them prioritize the chart or charts to audit. The MRA Calculator determines relevant HCCs from observed diagnosis codes, the corresponding Medicare Risk Adjustment (MRA) score and the estimated change in medical premium, both monthly and annual, to expect from coding capture. Use the search bar to find a code by name or number!

FRG also integrated CMS’s official coding tips and remarks to improve the user experience and make it easier to know what must be done to realize the results of modeling. These tips just set the tool apart even further from other online risk adjustment tools

Top 5 Reasons to Use FRG’s MRA Calculator

Guaranteed Confidentiality

The MRA Calculator doesn’t save any information you enter! It runs on your browser your local browser with a light API exchange of codes to the modeling computer. It is designed for interactive, ad hoc use. You don’t even have to record a patient name!

After you close your browser, the data you entered is gone! Review and model charts privately, save your results locally in PDF or Excel and close your browser. It’s that simple.

Improved Coding

Certified Professional Coders (CPCs’s) use FRG’s MRA Calculator’s powerful search box to match diagnosis codes they observe documented in a chart to valid choices in the ICD-10 to HCC matrix. Then, they review the in depth notes about diagnosis references to understand how they will contribute to the overall score and whether they will be dropped due to the hierarchical rules. To eliminate confusion, the MRA Calculator indicates which code were superseded by others when some diagnoses are redundant.

Simple Interaction

The MRA Calculator is easy to use. Enter a patient name or leave it blank, enter the basic demographic information and the patients dual or non-dual status, report new enrollment and institutional status, and then, search and add diagnosis codes to the profile. The user-friendly and intuitive layout of the MRA Calculator interface helps users quickly ease into their chart reviews.

The risk score changes as you specify patient demographics and their diagnosis codes. You can even tune the model to specific county rates! When users are finished adding all the information, they’ve got the option to download or print a PDF report.

Easy to Afford, Free to Try

The MRA calculator only costs users $50 per month, and can be stopped or started at any time. No contracts! This is much less expensive than other tools that lock users in an agreement for a year. Teams of five or more receive a 20% discount with the group rate! Even better: it’s free to try for 30 days! The trial period affords users to plenty of time to see for themselves the effectiveness of the tool, how easy it is to use and how helpful it is to have a confidential MRA calculator on demand.

Ready to get started?

To learn more about MRA Calculator or to start your free trial, visit the MRACalculator.com website or click here to go there automatically.

Next Stop: Improved Productivity

For those who need to evaluate multiple cases, or want to save their results and see the impact of dropped condition codes quantified for a full panel or panels so they can prioritize charts to audit and members to schedule, FRG as developed a new service called the Revenue Audit and Monitoring Program (RAMP™).

We joined the technology of the MRA Calculator with the reporting flexibility of AccuReports® by FRG and added a team of Certified Professional Coders (CPC®) to interpret and test the results. RAMP™ customers receive, as it the name implies, monthly revenue monitoring in the form of MRA and premium change analysis, member-coding gap stratification, comprehensive and supplemental chart reviews and regular guidance. This valuable insight helps teams understand the effectiveness of their own risk adjustment programs, prioritize outreach to members who need to be assessed and achieve shared savings goals. Together, these services mean improved productivity!

Contact FRG Systems

888-466-1025

info@frgsystems.com

1351 Sawgrass Corporate Parkway, Suite 101

Sunrise, FL 33323

Leave A Comment